For your consideration I present

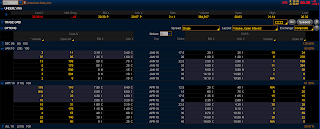

NITE - Knight group - market making group and

ADY - American Dairy - Dairy products company operating in China.

It's possible to play the rise as stock and option play.

NITE had a huge drop from recent all time high of 23.11 and there have been several times the stock hit $14 area and reversed, so I'm counting to see similar behavior. Would not want to hold it below 13.50.

Can also play it via selling 15/12.5 JAN put vertical for about .80 cents (mid-price is .82)

Max loss: 168

Max gain: 82.

Break-even: 14.18

This trade can benefit from three things:

- Directional increase in price

- Time decay

- Volatility decrease

For the second play:

May 14, 2009: close: 18.43, high: 19.37

May 15, 2009: open: 23.45, close: 28.48

We have touched $20 level Jul 13, 2009 and we're touching that level now. The formation is not the prettiest, it resembles a flat base descending triangle on daily, but can also be looked at as a double top forming on daily around $20 level. However, I would not be too surprised if we make way into 18 3/4 area.

ADY is optionable, and can be traded by selling JAN 20/17.5 put spread for .80.

APR spread with same strikes goes for 1.05, but I don't like it as much because there's not that much compensation for extra 3 months of waiting as APR composite volatility is 38%, but JAN comp. vol is 51.35% so time decay costs more in JAN.

Well that's it for today.